Reg D Rule 506 Bad Actor

This rule a product of the jobs act became effective on september 23 2013 and is the original source of the bad actor rule.

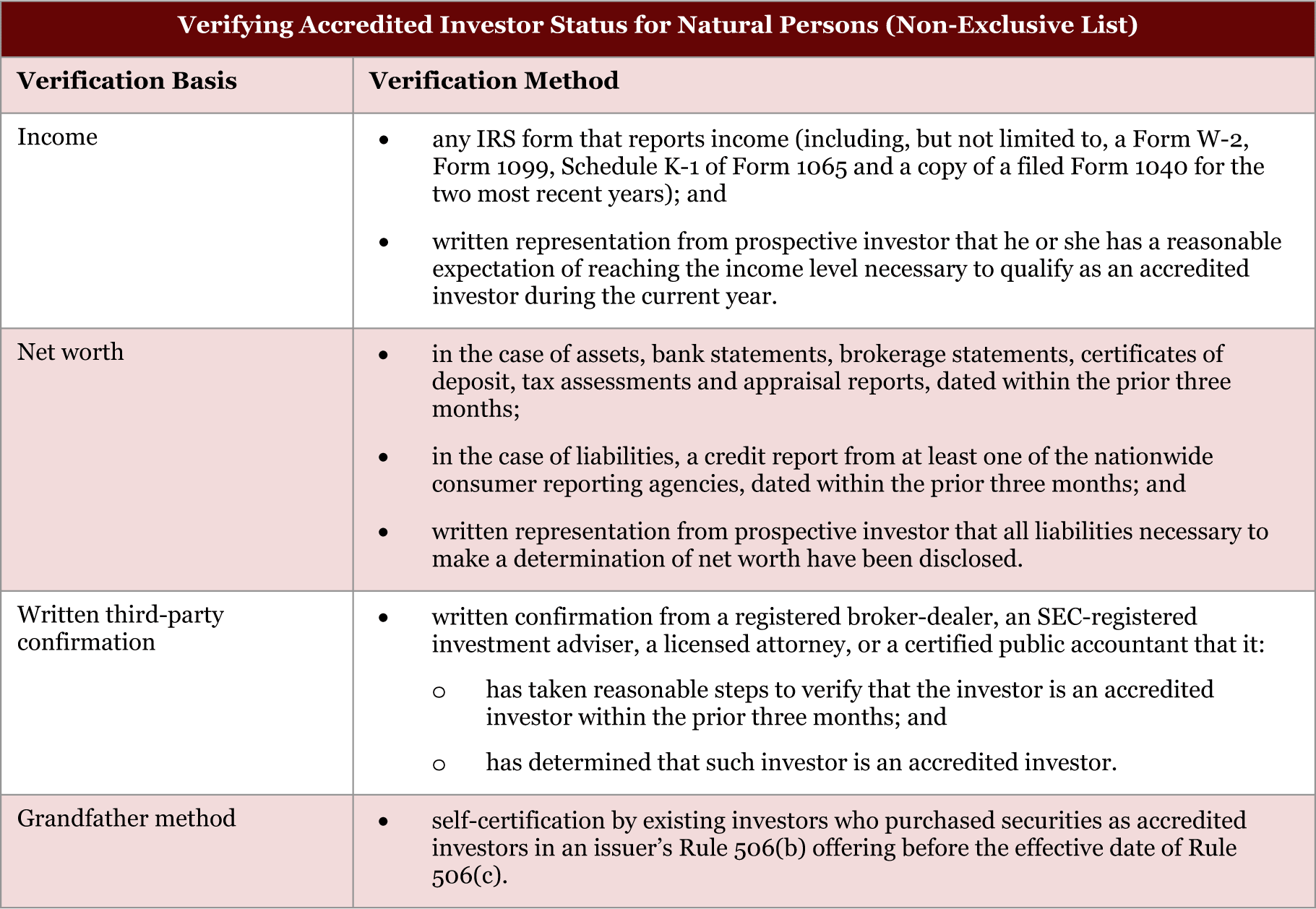

Reg d rule 506 bad actor. Rule 506 d identifies certain persons that may potentially become bad actors it also lists certain events disqualifying events or bad acts. Rule 506 is the most commonly used regulation d exemption. D in regard to any person who purchased securities in an issuer s rule 506 b offering as an accredited investor prior to september 23 2013 and continues to hold such securities for the same issuer s rule 506 c offering obtaining a certification by such person at the time of sale that he or she qualifies as an accredited investor. Rule 506 c allows for general solicitation of accredited investors.

Section 926 requires us to adopt rules that disqualify securities offerings involving certain felons and other bad actors from reliance on rule 506 of regulation d. The rule became effective september 2013. Unlike rule 505 of regulation d regulation e and regulation a rule 506 of regulation d historically did not contain bad actor disqualification provisions in may 2011 the sec proposed amendments to rules promulgated under regulation d to implement dodd frank act section 926 s provision regarding the bad actors for regulation d final bad actor rule was adopted in conjunction with the adoption of final rule relating to rule 506 offerings.